Mortgage Basics

Credit Report

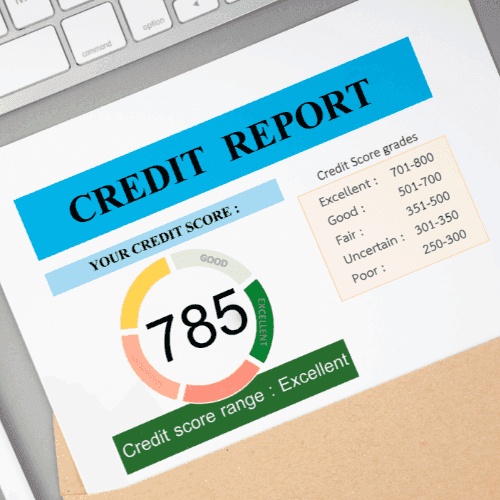

Your credit report is a cornerstone of your financial profile, especially when applying for a mortgage. It’s more than just a number—it’s a detailed snapshot of your borrowing history that lenders use to evaluate your financial health and reliability. Whether you’re buying your first home or refinancing, understanding your credit report is crucial. This guide breaks down the essentials of credit reports, what they include, how to access yours, and why it matters for your mortgage journey.

What is a Credit Report?

A credit report is a comprehensive record of your credit history, maintained by major credit bureaus like Experian, Equifax, and TransUnion. It includes details about your loans, credit cards, payment history, and public records like bankruptcies or liens. Lenders use your credit report to assess how well you manage debt, helping them determine your creditworthiness and loan eligibility. Your financial health and reliability is represented as your credit scores. For homeowners and buyers, this document is a critical tool in securing favorable mortgage terms. Regularly reviewing your credit report can help you identify errors, detect fraud, and maintain a healthy credit profile.

What is on a Credit Report?

Your credit report contains key financial details, including:

- Personal Information: Name, address, Social Security number, and employment history.

- Credit Accounts: Information on current and past credit accounts, such as credit cards, mortgages, and auto loans, including balances, limits, and payment history.

- Public Records: Details of bankruptcies, tax liens, or legal judgments that impact your financial standing.

- Credit Inquiries: A record of who has accessed your credit report, categorized as hard or soft inquiries.

Each piece of information helps lenders determine your financial habits. For mortgage applicants, factors like on-time payments and a low credit utilization ratio can significantly boost approval chances.

How Can I View my Credit Report?

Since your credit report significantly impacts your credit score, it's crucial to ensure its accuracy before applying for credit. You can obtain your credit report from the three major credit reporting agencies:

- Equifax: (800) 685-1111

- Experian: (888) 397-3742 (EXPERIAN)

- TransUnion: (800) 916-8800

These agencies may charge a fee of up to $9.00 for a copy of your credit report. However, you are entitled to one free credit report every 12 months from each of the three major credit reporting agencies. This free report may not include your credit score and can be requested at AnnualCreditReport.com.

How Does My Credit Report Affect My Mortgage?

Your credit report plays a vital role in your mortgage application. Lenders use it to find out your credit score, which influences your loan terms, interest rate, and approval odds. A higher score can secure better rates, while a lower score may limit your options or require additional conditions like a larger down payment. Maintaining a clean credit report is one of the best ways to strengthen your mortgage application.

Myths vs. Facts About Credit Reports

Understanding your credit report means separating common myths from the facts. Here are some misconceptions and the truths behind them:

Myth: Checking my own credit report will lower my credit score.Fact: Viewing your own credit report is considered a soft inquiry and has no impact on your credit score. Regularly reviewing your report is a smart way to stay informed.

Myth: Closing old credit accounts will boost my credit score.

Fact: Closing accounts can actually lower your score by reducing your available credit and shortening your credit history, both are key factors in determining your score.

Myth: Only negative information affects my credit score.

Fact: Positive habits, like making on-time payments and maintaining low balances, are equally influential in shaping a strong credit profile.

Myth: All credit reports are identical.

Fact: Different credit bureaus may report varying information depending on what creditors choose to share with them, so it’s important to check all three major reports.

Myth: A credit score is the same as a credit report.

Fact: A credit score is a numerical summary of your credit report, but your full report contains detailed information lenders review during the mortgage process.

Take Control of Your Credit Report Today

Your credit report is a vital tool in the mortgage process, offering lenders insights into your financial reliability. By understanding what’s on your credit report, regularly reviewing it, and making improvements where necessary, you can enhance your credit profile and improve your chances of securing favorable mortgage terms. Whether you’re planning to buy a home or refinance, being proactive about your credit report will set you up for success.