Mortgage Basics

What is a VA Loan?

A VA loan is a mortgage program created by the U.S. Department of Veterans Affairs (VA) to assist eligible veterans, active-duty service members, and certain military spouses in becoming homeowners. Established in 1944 as part of the Servicemen’s Readjustment Act (commonly known as the GI Bill), this program was designed to make homeownership more accessible and affordable for those who have served our country. Offering benefits like no down payment and competitive interest rates, VA loans are issued by private lenders such as banks and mortgage companies but are backed by the federal government to protect lenders against loss if the borrower defaults.

How Does a VA Loan Work?

Unlike conventional loans, VA loans are backed by the federal government, providing lenders with a guarantee against losses. This means they will pay a portion of the loan back in the event the borrower defaults on the mortgage which makes it possible for eligible borrowers to secure favorable loan terms without requiring a large down payment or private mortgage insurance (PMI). VA loans are not issued directly by the VA but by approved private lenders, making it essential to choose the right lender for your needs.

When you secure a VA loan, you’ll have access to flexible terms and protections that prioritize your financial well-being. These loans are specifically designed for purchasing, building, or refinancing a home you plan to occupy as your primary residence.

Who Can Benefit from a VA Loan?

The VA loan program is available to:

- Veterans who have served honorably.

- Active-duty service members.

- National Guard members and reservists.

- Certain surviving spouses of deceased veterans.

Eligibility requirements vary based on your length and type of service, so obtaining a Certificate of Eligibility (COE) is the first step in the process. A knowledgeable mortgage broker can assist you with this, making it easier to verify your qualification.

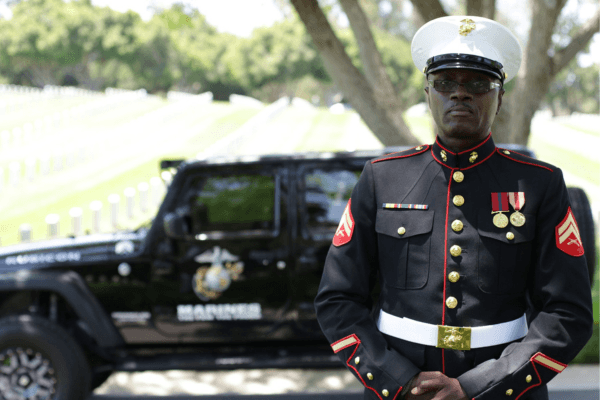

A Loan Built for Heroes

A VA loan isn’t just a mortgage—it’s a pathway to homeownership for those who have served our country. With unique benefits like no down payment and flexible credit requirements, VA loans empower veterans and service members to achieve their dream of owning a home. Choosing the right lender and working with a skilled mortgage broker can make the process seamless and ensure you’re getting the most out of this valuable benefit.