Mortgage Basics

Who is Eligible for a VA loan?

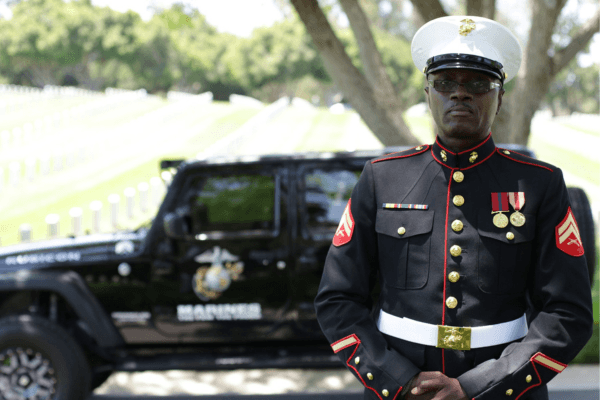

VA loans are one of the most valuable benefits available to veterans, active-duty service members, and their families. Offering no down payment, competitive interest rates, and other unique advantages, VA loans empower those who have served our nation to achieve homeownership. However, understanding eligibility requirements can be overwhelming. This guide breaks down who qualifies and how a mortgage broker, like Vision Home Mortgage, can simplify the process for you.

The U.S. Department of Veterans Affairs (VA) has specific eligibility requirements for VA loans based on your military service, discharge status, and other factors. Below, we explore the primary eligibility categories: wartime service, peacetime service, Reserves and National Guard, and surviving spouses.

Wartime Service Eligibility

Veterans who served during wartime periods may be eligible if they meet the following criteria:

- Service Requirement: At least 90 days of active duty without a dishonorable discharge.

- Qualifying Wartime Periods:

- World War II: September 16, 1940 – July 25, 1947

- Korean Conflict: June 27, 1950 – January 31, 1955

- Vietnam Era: August 5, 1964 – May 7, 1975

- Persian Gulf War (ongoing): Check with the VA for the latest updates.

- Afghanistan & Iraq: Service dates vary; consult your VA Regional Office for specific eligibility.

- Service Requirement: A minimum of 181 days of continuous active duty without a dishonorable discharge.

- Qualifying Peacetime Periods:

- July 26, 1947 – June 26, 1950

- February 1, 1955 – August 4, 1964

- May 8, 1975 – September 7, 1980 (Enlisted)

- May 8, 1975 – October 16, 1981 (Officer)

- Veterans whose service began after September 7, 1980 (Enlisted) or October 16, 1981 (Officer) must have completed 24 months of continuous active duty or the full term they were called to service.

Peacetime Service Eligibility

Veterans who served during peacetime are also eligible under certain conditions:

Members of the Reserves or National Guard may qualify for a VA loan if they meet one of the following criteria:

- Served at least six years in the Selected Reserve or National Guard and were honorably discharged, retired, or transferred to the Standby Reserve.

- Served at least 90 consecutive days of active duty during a wartime period or were activated for service.

VA loans extend benefits to the spouses of veterans in specific situations:

- The surviving spouse of a veteran who died in service or from a service-related disability.

- The spouse of a veteran who was listed as a Prisoner of War (POW) or Missing in Action (MIA) for more than 90 days.

- The surviving spouse must not have remarried unless certain exceptions apply.

Determining VA loan eligibility involves understanding detailed criteria, obtaining a Certificate of Eligibility (COE), and navigating the mortgage process. A trusted mortgage broker, like Vision Home Mortgage, can streamline this journey by helping you gather necessary documents, evaluate your options, and connect you with lenders experienced in VA loans.

Unlock Your VA Benefits with Confidence

Navigating VA loan eligibility doesn’t have to be daunting. Whether you served during wartime, peacetime, or as a member of the Reserves or National Guard, a VA loan could help you achieve your dream of homeownership. Vision Home Mortgage is here to guide you through the process, ensuring you maximize your benefits while enjoying a smooth and stress-free experience. Contact us today to get started.