Mortgage Basics

VA Loans

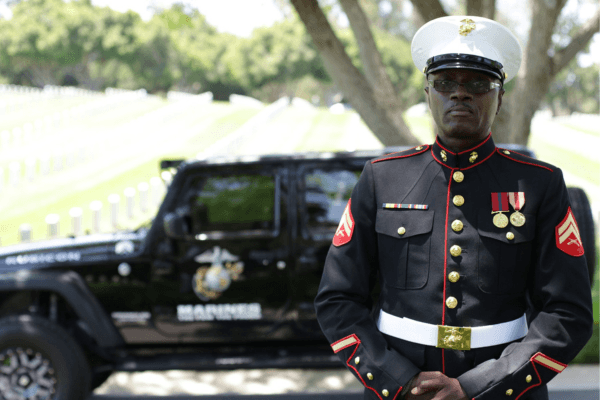

VA loans are a powerful benefit available to eligible service members, veterans, and their families, offering unique opportunities for homeownership. This type of loan comes with several advantages, including no down payment and competitive interest rates, making it an attractive option for those who qualify. However, understanding the full scope of VA loans—who is eligible, what they can be used for, and the process of applying—is essential for making informed decisions. On this page, we’ll cover the basics of VA loans, including eligibility, benefits, drawbacks, and the steps to secure this valuable resource. Whether you’re considering your first VA loan or wondering if you can use this benefit again, this guide will provide the insights you need.